Amaravathi, July 23: The Telugu Desam Party (TDP) on Saturday expressed serious concern over the alarming economic situation in the State.

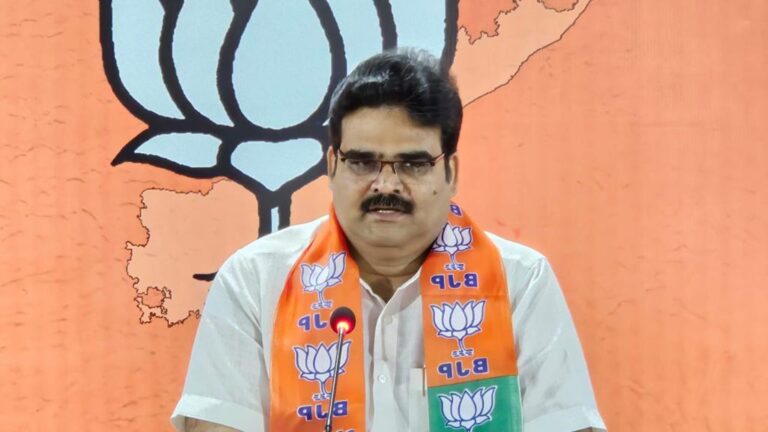

Party national spokesperson Kommareddy Pattabhiram told media persons at the party office here that for the past few months the whole nation has been discussing the financial crisis in the State, particularly after the scary Sri Lankan situation, the situation is more alarming. Serious debates are on in the State going for debts under various heads, including in the name of corporations, and the huge amount of interest being paid, he said.

Even FRBM norms are being totally violated to raise loans and Andhra Pradesh stood on top in the country in the amount of debts raised this year. Also, several shell companies are set up only to loot various banks in the name of loans, he alleged.

Pointing out that a whooping Rs 25,000 cr loan is raised from different banks by setting up a company in the name of Andhra Prdesh State Development Corporation and this amount is being diverted, Mr Pattabhiram said and clarified that the TDP is opposing only such diversion of funds but not spending money to take up welfare schemes.

Even the Reserve Bank of India (RBI) pointed out that the guidelines issued by the bank are thrown to the winds while raising loans. After observing all this, the RBI issued revised guidelines to the scheduled banks on June 14, 2022 that the norms be strictly followed.

The RBI in the latest circular pointed out that “We have come across instances where banks have not been strictly complying with our extant instructions on assessment of commercial viability, ascertainment of revenue streams for debt servicing obligations and monitoring of end use of funds in respect of their financing of projects of government owned entities. Banks/ FIs have also been found to have violated our instructions which, inter alia, require that in case of projects undertaken by government-owned entities, term loans should be sanctioned only for corporate bodies; due diligence should be carried out on viability and bankability of the projects to ensure that revenue stream from the project is sufficient to take care of the debt servicing obligations; and that the repayment/ servicing of debt is not from budgetary resources,” he said.

The scheduled banks are even advised to carry out a review and place before their boards, a comprehensive report on the status of compliance with the instructions within three months from the date of this circular, Mr Pattabhi added. The RBI also clearly mentioned in its circular that “it should be ensured by banks and financial institutions that these loans/investments are not used for financing the budget of the State Governments and the State Government guarantees may not be taken as a substitute for satisfactory credit appraisal.”

When the RBI issued such clear instructions, the State Government violated all the norms and issued various GOs setting up corporations like the APSDC, he said adding that this is the performance of the State Government. “Implementation and funding of Jagananna Amma Vodi Programme for the financial year 2020-21 by Andhra Pradesh State Development Corporation” mentioned in the GO No 3, issued on January 8, 2021, is nothing but to swallow the funds, he said.

The agreement made in the name of the Governor clearly mentions that even if the State revenue falls after imposing prohibition and the revenue fron the Excise Departments falls, the banks are not responsible as the State Government stands guarantee to repay. Also, the pact clearly mentions that the State Government is considered as the principal debator.

When a pensioner in Stya Sai district, Lalitha Bai, questioned the local MLA, instead of resolving the issue, a case has been booked against her, he pointed out and said that the TDP will bring awareness among the people as to how the Chief Minister, Mr Jagan Mohan Reddy, is acting as an economic terrorist. The TDP has been pointing out since beginning that Mr Jagan Mohan Reddy has been making the borrowings in the name of corporations only to escape from the FRBM limits, he said.

At least Rs 10 lakh crore is credited to Mr Jagan accounts and the people should, at least now, realise the economic condition of the State after the RBI’s letter and what reply the Finance Minister, Mr Buggana Rjendranath Reddy, will give now, Mr Pattabhi asked